Historically and simplistically speaking, market research is often a tool used to help clients make informed decisions relative to media buying. The typical scenario used to look like this:

Our clients would buy media based on a series of inputs; survey data being just one. If a client wanted to advertise their new sports product, they’d likely purchase an ad spot in the sports section of a newspaper or on ESPN.com. If a second client wanted to promote the upcoming season of their TV show, they might advertise for it on a series of entertainment focused websites. In this model, media content was a proxy for media buying. The decision was likely influenced by several data points, i.e. survey data, viewership information or market trend data. The assumption was if a consumer was looking at ESPN.com or reading the sport section of a newspaper, they may be interested in the first client’s sports product. If a consumer is surfing one of those entertainment websites, they may be more interested in the upcoming season of the second client’s show.

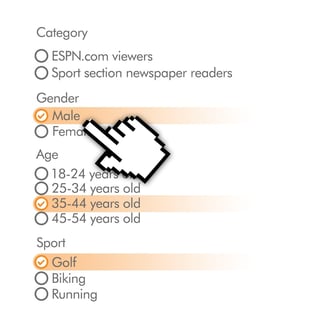

However, as the ad tech space has accelerated, more targeted purchasing of AUDIENCES has emerged. For example, using the sports analogy above, the client might now target the audience of “males, 35-44, who are interested in golf”. The client wouldn’t only receive access to audiences similar to that of ESPN.com or the sport sections of the newspaper, but across the whole digital ecosystem. With the evolution in the ad and marketing sector, the outcomes from market research projects and the role we play as market research suppliers is changing too. Brands are increasingly less interested in what media to buy and more interested in what audiences to activate.

As researchers, we need to support clients’ ability to identify and activate an audience. If we can provide clients with a rich audience description as the output of their survey, they can buy against that specific audience on their ad buying platform. To be able to provide that audience description in a language already spoken by digital advertisers is even more powerful. Suddenly we’re speaking a common language and unlocking greater digital research and advertising ROI as a result.

According to last year’s GRIT survey, market research is a $44B worldwide business. By comparison, digital advertising represents $60B in the United States alone. If you were in need of some motivating evidence to help influence decision makers at your organization to invest in this area, these figures are worth referencing. In the past, there was very little opportunity to directly link “traditional” online research to ad or media buys. The firms who are able to best start crafting research outputs that guide digital ad buying will play a pivotal role in the progression of our industry. Lightspeed GMI's recently launched AmplifyR Appends serves as tools to use in helping clients commit to more research guided audience targeting off and online.