When you need to search for something on the internet, where do you go first?

If your gut reaction was Google, you’re not alone – nearly 3 of 4 people in a recent Lightspeed quick poll indicated that when they seek an answer to an arbitrary trivia question, specific product information, the location of a physical store, or just general wisdom on the internet, Google is their search engine of choice.*

But search is all about context, and for market researchers, that context is everything. We understand the value of time, and more increasingly we need to adapt our research methods towards time poor consumers. In our Marketing Data Integration series, we’re exploring new ways to modernize quantitative research, and odds are some of your research question have already been asked. So why not try search as an initial step in the research process? Like with Google, you can leverage collective knowledge with on-demand access. Think respondent first and eliminate asking questions in your surveys that others have already answered.

What’s the benefit to me?

Lightspeed’s tools make it easy to search thousands of studies and rich data sets (including non-proprietary studies, incidence checks and profiler data) to get quick answers and recent incidence rates -- improving speed to answer. Why should search be a part of your research process? Let’s look at three key ways:

Has it been successful yet?

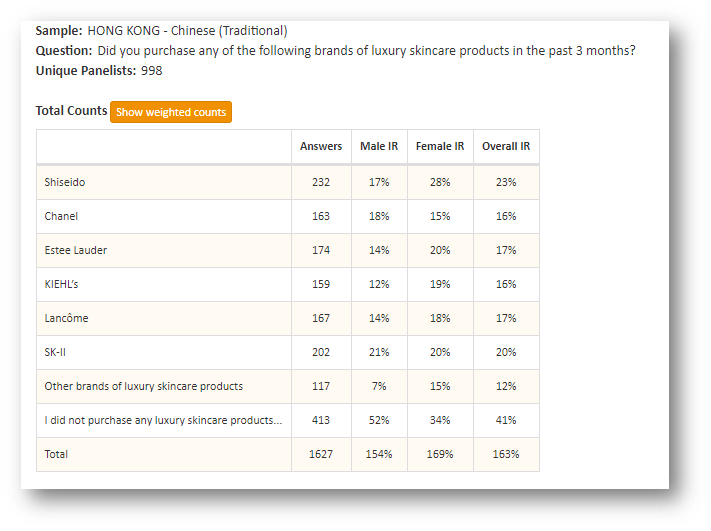

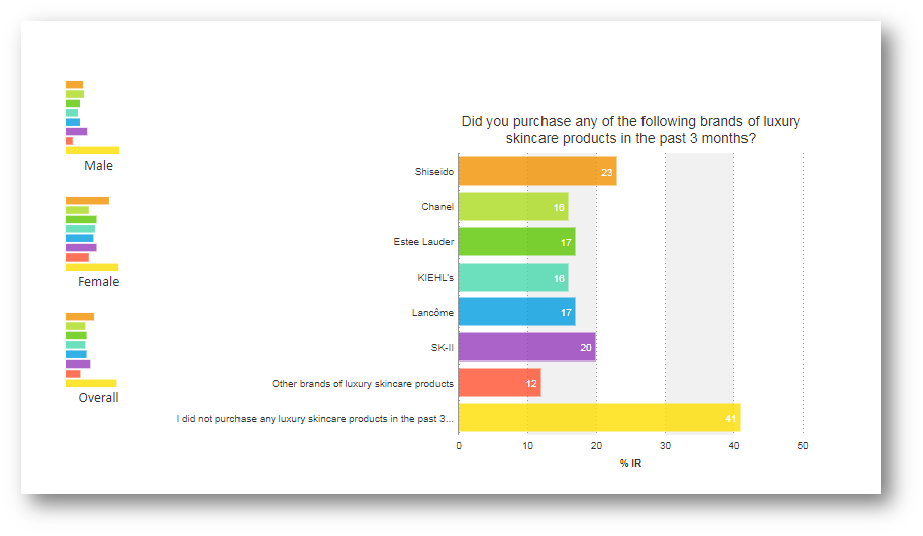

Let’s look at a case study and see how search impacted a recent project: Lightspeed helped a client agency quickly discover awareness levels of various Luxury Skincare brands without conducting a full-blown research study – keeping prices low and delivering insights faster, including delivery of results weighted to nationally representative sample.

They asked: “Hey Lightspeed, our FMCG skincare client is looking to understand brand purchase behavior in the category in the Hong Kong market, what does it look like over the past 3 months?”

And we provided:

Here’s another example of how an agency client put the importance of search and quick polling into context:

“Lightspeed’s search and polling tools came through for us last night. We are working on a multi-agency pitch for a client that has hundreds of inconsistent research studies and insights. We were able to see existing survey questions on their category, as well as to launch over 30 multi-market surveys last night – and then came into the office this morning with responses from all over the world. For our insights kick-off meeting today, we were the most prepared team with invaluable insights from across the globe as a consistent starting point.”

So, before you ask, search.

*Source: Lightspeed survey of 1,016 US consumers 18+ fielded August 7, 2018.