While more than 80% of US consumers are aware of the Equifax data breach announced this month, relatively few have taken actions beyond checking their credit card transactions a little more closely, a new Lightspeed survey reveals. But they want assurances of monitoring from their banks and credit card companies.

Not surprisingly, there’s confusion in the market about the data breach, and trust in credit reporting agencies is low. In fact, given the similarities in the names of Equifax and Experian, fully 15% of the unaided mentions of a company with a recent data breach were Experian -- not Equifax.The Lightspeed survey of 2,500 consumers conducted online this month shows that banks and credit card issuers are not completely in the clear. While 57% of consumers say credit reporting services are responsible for protecting consumers' information, 45% also believe banks and credit card issuers are responsible for safeguarding information.

Consumers say they're looking for reassurances from their banks and card issuers about the security of their data. Nearly 60% of consumers believe their banks and card issuers should tell them whether or not they were impacted by the breach (which may be impossible) and more than 40% want to know their card issuer is monitoring their accounts.

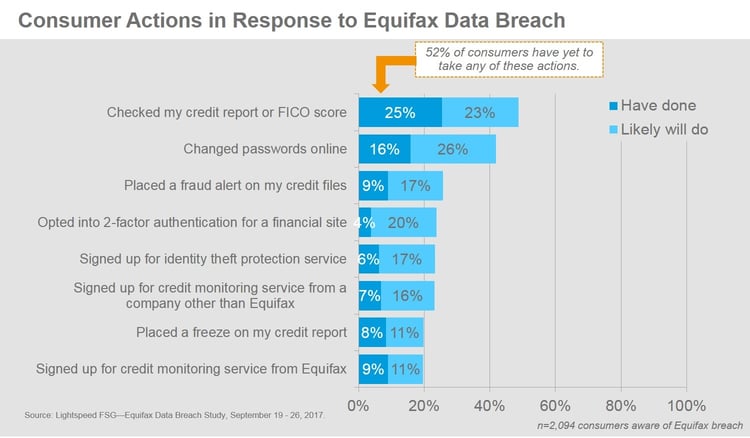

What have consumers done in response to news about the breach? Roughly 45% of consumers say they've reviewed their credit card transactions as a result of hearing about the data breach, but not much else. Relatively few say they've stopped using credit cards, changed their passwords online, or requested a credit freeze. Just under 20% have signed up for credit reporting -- about 9% from Equifax and 7% from another company.

In fact, just over half of consumers (52%) who are aware of the data breach say they've taken none of these steps to monitor their accounts or restrict use of their credit profile.

These results are based on an online survey of 2,506 US consumers. The final sample was weighted to be representative of the U.S. consumer population based on age and gender. The study was fielded September 19-26, 2017. (The Equifax data breach was reported by the news media starting on September 7, 2017.)